What Growing Interest Rates Mean for Potential Buyers

Jason Cummings | June 2, 2022

Jason Cummings | June 2, 2022

If homeownership has been on your radar lately then you are probably aware of the current rise in interest rates and wondering how that will affect your ability to purchase a home. Interest rates are on the rise again after hitting a historic average low of 3.11% in 2020, greatly due to the effects of COVID-19. Today the average stands at about 5%, and even though this is still less than that of the typical average around 8% this rise in rates will certainly have an impact on future homeowners seeking a loan.

Mortgage interest rates have a direct impact on monthly payment calculations and therefore on the amount that borrowers can qualify for when purchasing a home. However, it’s important to keep in mind that studies have shown that most homeowners do not live in their homes for the full 30 years, so homeowners are not likely to pay all of the interest shown in amortization schedules. Additionally, there is the option to refinance your mortgage down the line if interest rates drop in response to future market conditions. The approach of trying to wait and time the market for a lower interest rate can be alluring but can also get buyers into trouble. Forecasting changes in the market such as lowered interest rates is historically difficult even for market experts as there are countless factors that contribute to market conditions. With rates likely to continue rising for the foreseeable future and home price appreciation expected to slow but not stop, homes that were once within budget for buyers will continue to grow.

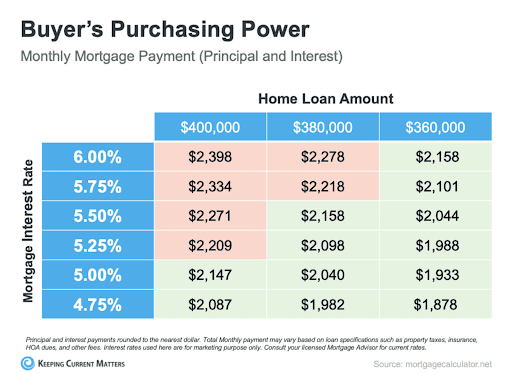

Probably the most anticipated factor resulting from increasing rates is the cooldown of demand, potentially leading to a less competitive market on the buyer’s side. According to a Forbes article titled, “Mortgage Interest Rates Forecast: How High Will Rates Climb In 2022?”, the author writes that, “higher mortgage rates will inevitably pull home sales down in the coming months and slow home price appreciation”. The table below provides some examples of the effect of higher rates on monthly payments which directly correlate to higher monthly payments. Since rates are increasing, people who were once able to afford a $400,000 home are now having to decrease their budget to fit the new mortgage rates in order to be able to afford their monthly payments. This is also considered ‘losing buying power’ since the growing rates are limiting options for future homeowners and in this on-fire seller’s market, buyers need all the power and support they can get.

Similar to “location, location, location” being a vital component in real estate, context is a vital consideration when analyzing a market. Even though interest rates are rising and greatly affecting the affordability of homes, the current mortgage rates are still more affordable than ever before when comparing them to rates from 1971 to today. According to a Wall Street Journal article titled, “Millennials Are Supercharging the Housing Market”, author Nicole Friedman writes, “purchasing a home is still more affordable for many first-time buyers today than it was for older generations, said Mark Fleming, chief economist at First American Financial Corp. That’s because incomes are higher and mortgage-interest rates have declined from above 10% in the 1980s to around 3% today”. Growing interest rates are not ideal, however, these current rates shouldn’t completely deter you from buying a home. The decision to buy a home should be based on whether you are ready to become a homeowner not because you are timing the market. Time IN the market is always better than timing the market.

Stay up to date on the latest real estate trends.

Jason Cummings | November 17, 2023

The State of Colorado has countless attractions for any season, which is why it is such a popular place to visit and even to relocate to.

Jason Cummings | October 22, 2023

Newly constructed Southshore home boasting a stunning exterior & a 3-car garage.

Jason Cummings | October 4, 2023

This newly constructed, corner lot townhome, nestled just a stroll away from the serene Sloans Lake, offers a harmonious blend of contemporary living with modern featu… Read more

Jason Cummings | September 14, 2023

Jason Cummings | September 13, 2023

This newly constructed A-frame-esque home in Bailey, Colorado, offers the perfect blend of modern comfort surrounded by stunning natural beauty.

Jason Cummings | August 17, 2023

Jason Cummings | June 19, 2023

When you do find the property of your dreams, then learning the history of a house or property before purchasing it can be beneficial for several reasons.

Jason Cummings | June 15, 2023

Outstanding Infinity Vue on a large corner lot with a 3 car garage, situated in the highly desirable Willow Park neighborhood of Central Park.

Jason Cummings | June 8, 2023

Charming storybook home just a short walk to the shops + restaurants at East Bridge Town Center and F15 pool.

DENVER'S TRUSTED REALTOR®

The team combines expertise with a willingness to think outside the box and break the mold to stay on the cutting edge of a shifting real estate industry. Whether you’re thinking about listing a house, beginning your search for a new home, or have a question about the area, please feel free to contact us.